Global Capability Centres (GCCs) in India have evolved from supporting roles to tech powerhouses, aligning with parent enterprises to access vast digital talent pools. The growth of GCCs, showcased by market size reaching $60 billion, has created over 600,000 jobs, projecting $121 billion in revenue by 2030. These centers drive innovation in AI, IoT, and automation, reshaping global markets. With a focus on advanced skills and leadership, GCCs are pivotal in India's tech landscape, poised to drive organizational excellence and innovation.

In the evolving landscape of Indian tech, Global Capability Centres (GCCs) have transcended their traditional roles to become integral components of the tech industry's ecosystem. Once relegated to supporting Fortune 500 companies behind the scenes, GCCs have now emerged as tech powerhouses, seamlessly aligning with their parent enterprises to provide access to vast digital talent pools. This transformation has not only reshaped perceptions within the industry but has also elevated GCCs to global hubs of strategic operations.

The story of GCCs in India is a testament to this evolution. Almost four decades after Texas Instruments set up its R&D operations in Bengaluru, Indian GCCs have showcased the nation's formidable tech expertise, attracting global companies and catalyzing the creation of more tech jobs. This growth has fortified India's stature as a center for cutting-edge technological advancements.

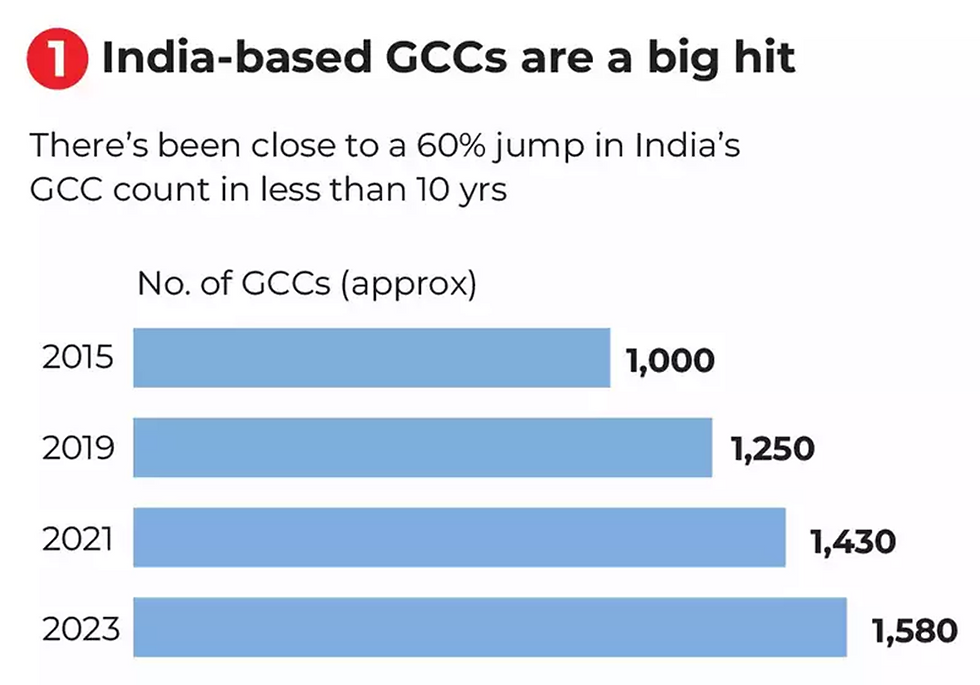

With approximately 1,600 GCCs currently operating in India and an estimated increase to 1,900 by the next year, these centers collectively represent a market size of $60 billion. The exponential growth in their market value, from $19.6 billion in 2014-15 to $46 billion in 2022-23, has been accompanied by the addition of over 600,000 new jobs between 2018-19 and 2023-24, bringing the total job count to more than 1.6 million.

Looking ahead, the Economic Survey paints a promising picture for GCCs, projecting a total revenue contribution of $121 billion by 2030, with exports accounting for $102 billion. The sector's expansion is exemplified by companies like JPMorganChase and Goldman Sachs, which have significantly increased their presence in India, leveraging the country's diverse talent for various business functions beyond technology.

Innovation lies at the core of GCC operations in India, with companies like Texas Instruments, Goldman Sachs, and GE Aerospace spearheading groundbreaking projects in chip design, trading platforms, and aviation technologies, respectively. These initiatives underscore the pivotal role that Indian GCCs play in driving innovation and technological advancements on a global scale.

As GCCs in India continue to ascend the value chain, there is a notable transition towards incorporating corporate functions, analytics, and AI, signaling a strategic shift towards higher-value work. With a focus on nurturing advanced skills and domain expertise, these centers are not only redefining the tech landscape but also reshaping global markets with their proficiency in areas like AI, IoT, and automation.

Moreover, GCCs in India are becoming known for offering competitive salaries, outshining their IT services counterparts in various leadership roles. This trend is expected to further solidify as more top leaders in GCCs command substantial compensation packages, emphasizing the growing importance of these centers in driving organizational excellence and innovation.

In conclusion, the trajectory of GCCs in India reflects a remarkable journey of growth, innovation, and transformation, positioning these centers as pivotal players in the global tech arena. With a focus on talent development, cutting-edge research, and strategic partnerships, Indian GCCs are poised to shape the future of technology and contribute significantly to India's economic and technological progress.

Comments