India has achieved a major milestone by exporting electronic components to China and Vietnam for Apple products like iPhones, MacBooks, and AirPods. This marks a pivotal shift, showcasing India's emergence as a global electronics manufacturing hub and reducing dependency on imports. Supported by Apple’s supply chain diversification and government incentives, India’s domestic component ecosystem is rapidly growing. Industry experts project exports could reach $35-40 billion by 2030, with suppliers like Tata Electronics, Jabil, and Aequs playing key roles in this transformation.

India has reached a significant milestone by exporting electronic components to China and Vietnam, marking a pivotal shift in the country’s role within the global electronics supply chain. These components are integral to the manufacturing of Apple products, including MacBooks, AirPods, Watches, Pencils, and iPhones. This development stands as a testament to Apple’s commitment to diversifying its supply chain and India's growing prominence in electronics manufacturing.

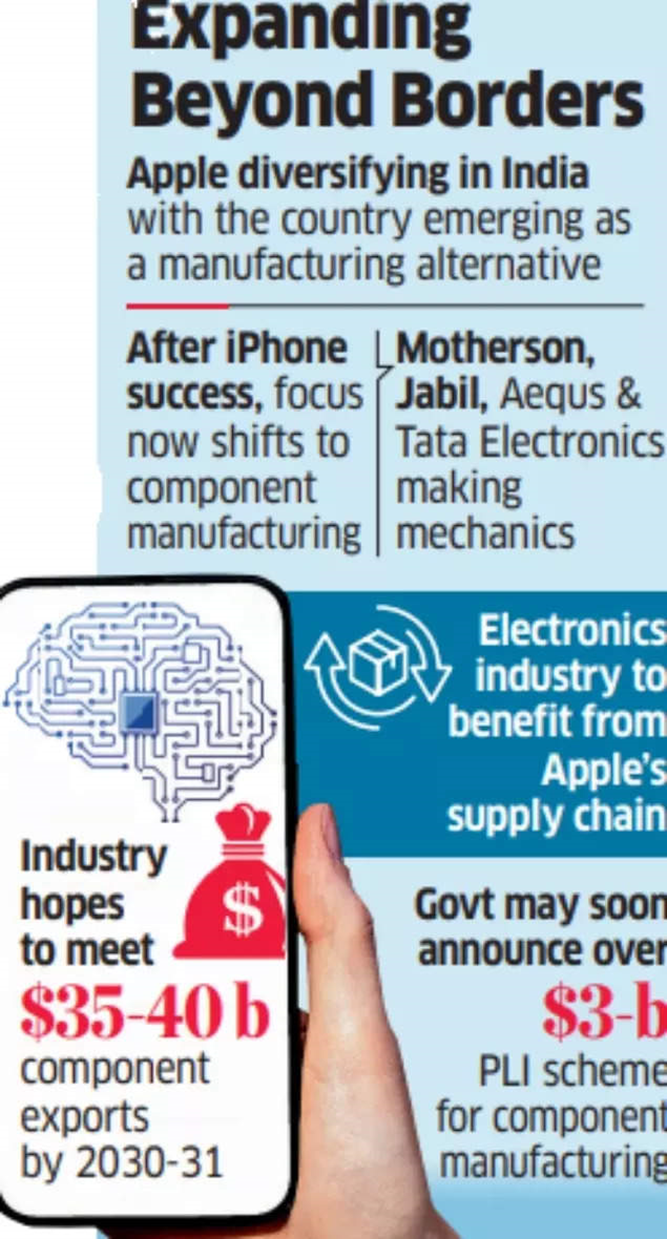

Industry experts hail this achievement as a transformative step for India’s electronics sector. It signals the emergence of a robust domestic component ecosystem, a remarkable development for a country that has relied heavily on importing components from China and Vietnam for the past two decades. This shift positions India as a key player in the global electronics industry, with analysts forecasting component exports to hit $35-40 billion by 2030.

Several Apple suppliers, such as Motherson Group, Jabil, Aequs, and Tata Electronics, are now producing high-quality mechanical components and enclosures for Apple’s product lineup, excluding iPads. These components are shipped to assembly hubs in China and Vietnam for final product assembly, according to industry insiders.

Apple’s Expanding Footprint in India

A source familiar with the matter revealed: “In its bid to deepen domestic value addition and build a local ecosystem (in India), Apple is expanding domestic procurement beyond iPhone and its key components. That is why the company has initiated this massive initiative to make mechanics, particularly enclosures, for its products.”

In alignment with this strategy, the Indian government is set to launch a production-linked incentive scheme worth over $3 billion to support component manufacturing and boost exports. Mechanical components, which house critical sub-assemblies like the motherboard and central processing unit, require advanced engineering and sophisticated machinery—areas in which India is rapidly gaining expertise.

Neil Shah, Vice President at Counterpoint Research, highlighted India’s growing importance in Apple’s supply chain, stating that the country now complements China and Vietnam by producing and exporting components for final assembly. Apple’s strategy includes forging partnerships with leading Indian manufacturers while encouraging its global suppliers to establish local facilities.

Over the past year, Apple has expanded its supplier base in India by onboarding two new companies. Jabil, based in Michigan, has begun producing AirPods mechanics at its Pune facility, while Aequs, located in Hubbali, Karnataka, manufactures MacBook mechanics. Motherson Group has also joined

Apple’s network, initiating production of iPhone enclosures.

Apple’s journey in India began three years ago when Tata Electronics became its first local supplier, manufacturing components for iPhone production. Tata Electronics has since enhanced its capabilities to cater to both domestic and export markets, including shipments to China. Recently, Jabil and Aequs have expanded their production portfolios to include mechanics for Apple Pencil and Apple Watch.

A Promising Future for Indian Manufacturing

Currently, Apple manufactures iPhones in India and is set to begin AirPods production soon. Components produced locally for other Apple products are exported to China and Vietnam for assembly. Shah described this development as a major milestone: “This is the beginning of a manufacturing ecosystem in India, exporting to China and Vietnam for the first time. While it’s mainly components like enclosures and others now, the ‘Make in India’ initiative promises more advanced component manufacturing in the future.”

India’s ascension in the electronics manufacturing sector follows Apple’s record-breaking achievement in iPhone exports. In 2024, iPhone exports from India surpassed ₹1 lakh crore, a testament to the country’s growing role in Apple’s global strategy. To further enhance local value addition, Apple has broadened its Indian supplier network to include companies such as Sunwoda for battery packs, Foxlink for cables, and Salcomp for coils, power packs, and magnetics.

This shift represents more than just a manufacturing milestone—it signals India’s rise as a global electronics hub, with a promising future ahead for advanced component production and exports.

コメント